A wave of good news knocked the doors of many central government employees and regular individuals when the NDA government announced that 40% of the withdrawals made in National Pension Scheme (NPS) after maturity will be tax exempted. This definitely brings in good news, as the value a subscriber takes home post-retirement is hefty. NPS is a government tool of investment which is best for low-class families as it requires very little investment every month from the citizens, but ensures massive returns on the time of retirement. NPS surely is a scheme for retirement and it guarantees a return. The power of NPS is such that one can even retire as crorepati.

So what does government mean by when they say 40% is tax exempted?

In PIB release, the Ministry of Finance said:

“Tax exemption limit for lump sum withdrawal on exit has been enhanced to 60%. With this, the entire withdrawal will now be exempt from income tax. (At present, 40% of the total accumulated corpus utilized for purchase of annuity is already tax exempted. Out of 60% of the accumulated corpus withdrawn by the NPS subscriber at the time of retirement, 40% is tax exempt and balance 20% is taxable.)”

When it comes to NPS, one should always be advisable to begin investment at an early age, as gains will be hefty on maturity. One can invest in NPS with minimum Rs 500 per month without any maximum limit. The maturity period of the NPS scheme is at the age of 60 years, and the pool has been known for giving interest rates between 8% to 14%.

Coming back to government’s new tax exemption rule. It needs to be noted that, on maturity NPS’ 40% gain needs to be transformed into an annuity which is later used for giving you a pension every month after your retirement age of 60 years. Now what has happened is that 60% of NPS lump sum you are allowed to withdraw – among which 40% will be tax exempted from the previous 20%.

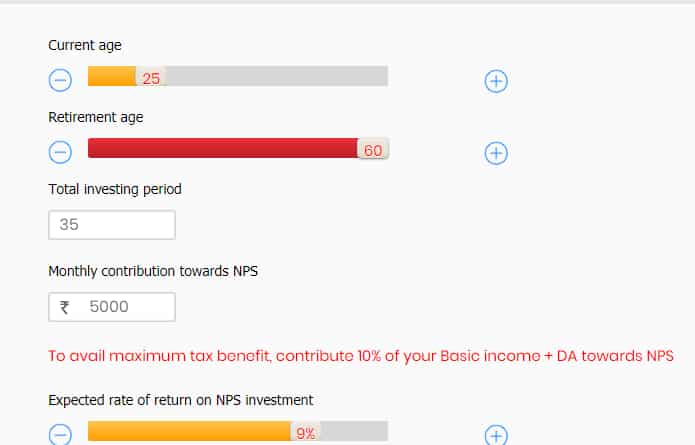

An example – For instance if you are a 25-year old and decide to invest Rs 5,000 every month in NPS at projected interest rate of 9% till your retirement age of 60, then you have invested about Rs 21 lakh for 35 years, and on which you have generated Rs 1.24 crore interest taking your overall pension wealth to Rs 1.45 crore!

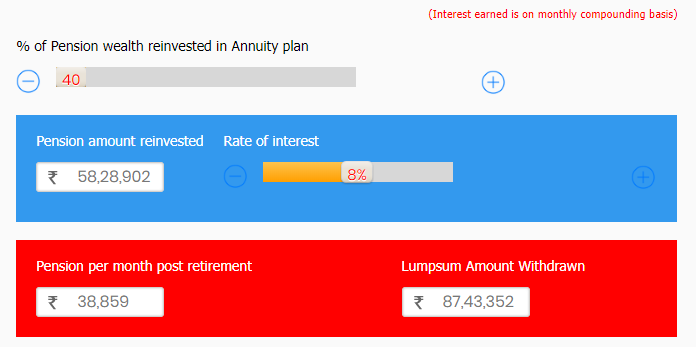

If you invest 40% of your pension wealth in an annuity, then from the total pension wealth – about nearly Rs 59 lakh has been removed from which you will receive every month a pension of nearly Rs 39,000 for the lifetime.

Remaining 60% gains, which come over Rs 87.43 lakh can be withdrawn. Now among this withdrawal amount – 40% which would be near Rs 35 lakh will be tax exempt!

This makes your gains heavy!

But shouldn’t you just do a ULIP!

Why compare ULIP with NPS is because the former has way better tax benefit than compared to the latter. Firstly, let’s know what exactly is a ULIP.

The Unit Linked Insurance Plan is a scheme where an individual’s investment is divided into a mix of insurance. As the name suggests, ULIP is seen to provide wealth creation along with life cover – under which an insurer invests a portion of your investment towards life insurance and remaining is divided between equity or debt or both as per your requirement. One of the interest facts of ULIP is that they can also be used for retirement planning, children education or other important events.

Looks like something which NPS is also giving already. The only difference is NPS does not offer life cover.

When investment in ULIPs are made, an insurance company takes a part of your premium and invests them into shares, bonds, etc. The remaining balance is used for insurance coverage. Unlike NPS, the lock-in period in ULIP is very short up to 5 years. However, considering its also an insurance cover, hence, a customer has an option to take investment in ULIP from 10 to 15 years.

Premium in ULIPs can be paid between lowest Rs 10,000 to maximum Rs 1.5 lakh.

Tax benefits of ULIP vs NPS!

Apart from the 40% tax exemption, a general citizen can avail tax benefit of Rs 1.5 lakh under section 80. Whereas a central government employee can claim up to Rs 2 lakh tax deduction under section 80C, section 80CCD(1) and section 80CCD(1B).

Guess what! Apart from Rs 1.5 lakh tax deduction under 80C, a ULIP gains after maturity is fully tax exempted under section 10(10D). But there ’s a catch, let’s find out!

In section 10(10D), upon completion of ULIP tenure, the amount received post maturity is completely exempted. In short, no taxes are levied on your gains.

Before and After the lock-in period!

For instance, if you have invested Rs 5 lakh in ULIP and your total gains excluding the invested amount comes at Rs 20 lakh. This means you take home about Rs 25 lakh.

But if you withdraw your policy before the lock-in period of 5 years, then the entire amount falls under tax slab.

If the ULIP is withdrawn after maturity, so let’s take the same example of Rs 5 lakh premium paid and gains of Rs 25 lakh. After maturity the gain Rs 20 lakh is entirely tax exempted.

Yes, you have read it right, that is one of the major factors that makes ULIP very exciting and amazing schemes. It would not be wrong to say, nobody likes to share the money earned on investment be to trim down in form of taxes, and ULIP is your that answer.

Hence, before opting for NPS make sure you are aware of ULIP. You can calculate your investment premium and project the gains you will receive under ULIP. An insurer will guide you with the procedures. Thereby, make a choice for yourself would you rather take NPS or ULIP is answers to your prays. Every penny earned must be invested wisely!