Maintaining a good credit score is crucial for obtaining bank loans and those failing to maintain optimum score are likely to be turned down. It will now become even more crucial for individuals to maintain a good credit score.

Some banks, which have already linked Reserve Bank of India’s external benchmark regime, look to utilise third-party credit scores to offer different interest rates on retail loans to potential buyers, reported The Economic Times.

HIGHLIGHTS:

- Banks have started using the credit scores of potential buyers to fix the interest rate on loans

- Those with a poor credit scores will end up paying a higher amount of interest on loans

- On the other hand, customers with high credit scores will benefit

For instance, Bank of Baroda will be using three credit score slabs obtained from the Credit Information Bureau (CIBIL) to fix interest rates on fresh home loans.

Customers who have a high credit scores (above 760 out of 900) will pay at least one per cent less interest compared to people with a score of between 675 and 724. Customers with a credit score below 675 are unlikely to secure any loans.

The report goes on to suggest that customers with a score above 760 will have to pay an interest rate of 8.1 per cent at Bank of Baroda while those maintaining in the range of 675-724 will have to pay an interest of 9.1 per cent. Therefore, maintaining a good credit score can significantly reduce the amount of interest you pay on home loans.

Meanwhile, those maintaining a score in the range of 725-759 will secure loans at 8.35 per cent interest.

While the above specifics apply to Bank of Baroda, the two other banks are also following a similar measure to help customers with good loan repayment history.

The RBI’s recent decision to allow large banks with several branches to charge a credit risk premium over external benchmarks for calculating real interest rate makes credit scores of borrowers a crucial aspect for determining retail loan interest rates.

As per the RBI’s mandate, all banks were required to adopt external benchmarks for pricing their floating interest rates on retail loans.

WHY MAINTAIN GOOD CREDIT SCORE?

Customers should note that just having a good credit scores at the time of securing a loan is not enough. As per the report, maintaining a good credit score throughout the lifespan of a loan will be equally important.

Since the rates will keep fluctuating based on a change in credit scores, it is important that customers who have taken loans maintain a good credit score. If the credit score falls, the floating interest rate would automatically increase. Maintaining a good credit score and getting a one per cent reduction in interest rate could save you lakhs on a long-term loan.

Syndicate Bank, which is merging with Canara Bank, is also expected to follow a similar pattern when it comes to offering retail loans. However, Syndicate Bank has decided to increase the credit risk premium for a borrower whose credit score drops by more than 50 points.

If the credit scores of an individual continues to deteriorate, the borrower could face higher interest rates as well. In a nutshell, people who default on EMI payments for more than 30 days for three times in the preceding one year can face a downgrade in credit score.

HOW TO CHECK CREDIT SCORE?

Since it is important for you to maintain a good score, it is crucial to keep checking it for better evaluation.

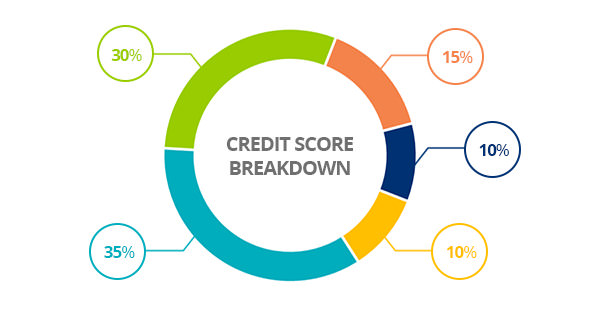

There are multiple credit information companies including CIBIL, Equifax, Experian and CRIF Highmark which generate credit scores of individuals. These scores are based on data provided by the banks and other entities who have loaned money to the borrower.

While some banks have stuck to internal credit assessment for loans, others have opted for external credit scores to keep a close eye on the borrowing activity of its customers.

With credit becoming a crucial factor used by banks for determining floating interest rates on retail loans, customers should make it a point to maintain a score of at least 760.