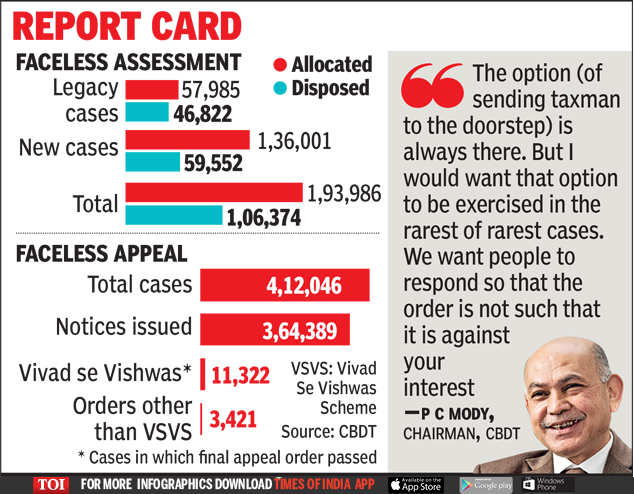

The government has issued close to 1.2 lakh orders under the faceless assessment schemes but finds itself in a spot as several taxpayers, whose cases were taken up initially, are not responding to notices issued electronically. This has prompted the Central Board of Direct Taxes to seek cooperation, failing which exparte orders may be issued or the taxman can come calling.

“Certain people are still not responding to notices, unless they respond, it will result in ex parte orders. Ideally, we don’t want that. In many cases, we have observed that they have not given email IDs. I hope people give their communication ID so that we do not have to resort to other means of communication, to visits,” CBDT chairman P C Mody told TOI.

The government has shifted to a faceless assessment and appeal mechanism to ensure that there is no face-to-face interaction with tax officers to avoid complaints of harassment. While the assessment system is stabilising, the appeal units were earlier asked to focus on smaller cases, because the numbers are larger. Mody said now there is no restriction.

Mody urged taxpayers to address specific queries raised by tax authorities and refrain from the use of unparliamentary language, something which was noticed in a few responses. He said the Information Technology Act provides for harsh punishment for use of abusive language.