India Post Payments Bank (IPPB) has tied up with PNB MetLife India Insurance Company Limited to offer Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY). In case you are considering a life insurance plan, you can check this unique scheme that offers life cover on the death of the insured member.

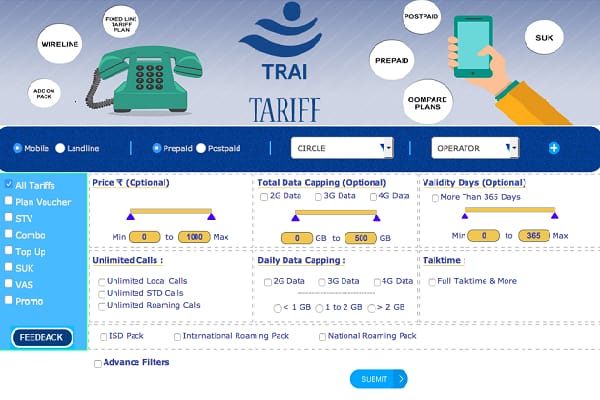

Also read: Recharge Plans: Airtel, Jio, Vi prepaid plans with 3GB daily data under Rs 500

The unique scheme offers life cover on the death of the insured member due to any reason. “Products like PMJJBY help to inculcate a culture of buying affordable insurance amongst this segment of the population,” J. Venkatramu, managing director and chief executive officer, India Post Payments Bank said.”PMJJBY takes forward the Government’s mission of creating a universal social security net for needy and disadvantaged sections,” he further added.

Here is all you need to know about the Pradhan Mantri Jeevan Jyoti Bima Yojana

1) The scheme will be optional for all the savings account holders with India Post Payments Bank. To open an account under Pradhan Mantri Jeevan Jyoti Bima Yojana, the Aadhaar card will be the primary Know Your Customer (KYC) document.

2) Customer should be at least 18 years old to enroll for the scheme. The maximum age limit will be 50 years for Pradhan Mantri Jeevan Jyoti Bima Yojana.

3) Benefits:: The fixed sum of ₹2 lakh upon the death of the insured member payable to the nominee. No maturity benefit or surrender benefit is payable under the scheme.

4) Premium: Customers need to pay a premium of ₹330 per annum. The scheme will be a one year cover, renewable from year to year. The fixed timeline will be from 1 June to 31 May each year.

5) The premium will be deducted from the customer’s savings account annually. The first premium will depend on the quarter in which the scheme has opted. Customer to maintain adequate balance in the account.

6) The life cover for the member shall terminate on attaining 55 years.

7) Risk coverage: The death benefit will be provided to the nominee of the policyholder on the occurrence of death after 45 days of enrollment. No cooling period is needed for deaths due to accidents.

8) Tax benefits can be availed on the premium paid under the policy under Section 80C of the Income Tax Act.

“Backed by our unparalleled reach on a Pan-India basis through the extensive network of Department of Posts along with PNB MetLife’s expertise, we aim to fulfill the needs and aspirations of different segments of the population, IPPB CEO added.

“We are proud to be a part of the Government of India’s initiative to provide life insurance solutions across a broad socio-economic spectrum and help new customer segments build their financial health and gain access to protection solutions through our partnership with India Post Payments Bank,” said Ashish Kumar Srivastava, managing director, and chief executive officer, PNB MetLife.