The Reserve Bank of India or RBI launched CMS, an application on its website, on June 24, 2019, for lodging complaints against banks and NBFCs with a motto to improve customer experience in timely redressal of grievances. The Complaint Management System (CMS) is a software application to facilitate RBI’s grievance redressal process.

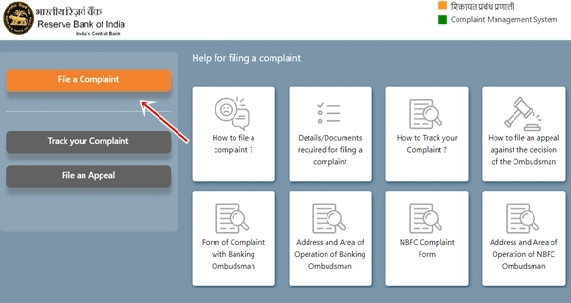

Customers can lodge complaints against any regulated entity with a public interface such as commercial banks, urban cooperative banks, Non-Banking Financial Companies (NBFCs). The complaint would be directed to the appropriate office of the Ombudsman/Regional Office of the RBI. Members of the public can access the CMS portal at RBI’s website to lodge their complaints.

RBI Governor Shaktikanta Das launched the Complaint Management System (CMS). Mr Das said application also improves transparency by keeping the complainants informed through auto-generated acknowledgments and enabling them to track the status of their complaints and file appeals online against the decisions of the Ombudsmen, where applicable.

He also informed that the RBI also plans to introduce a dedicated Interactive Voice Response (IVR) system for tracking the status of complaints. The RBI Governor stressed that sustaining the confidence of consumers in banks and other financial service providers (FSPs) through prompt and effective grievance redressal, together with empowering customers through education is pivotal for maintaining trust in the banking system.

Key Highlights:

- This system facilitates the regulated entities to resolve customer complaints received through CMS by providing seamless access to their Principal Nodal Officers/Nodal Officers.

- The system provides facilities for the generation of a diverse set of reports to monitor and manage grievances by the Regulated Entities.

- They can use the information from CMS for undertaking root cause analyses and initiating appropriate corrective action if required.

- The CMS also has facilities for RBI officials handling the complaints to track the progress of redressal.

- The information available in CMS could also be used for regulatory and supervisory interventions if required.

- With the launch of CMS, the processing of complaints received in the offices of Banking Ombudsman (BO) and Consumer Education and Protection Cells (CEPCs) of RBI has been digitalized.

Keeping the convenience of the customers in mind, CMS has been designed to enable online filing of complaints. It provides features such as acknowledgment through SMS/Email notification(s), status tracking through unique registration number, receipt of closure advises and filing of Appeals, where applicable. It also solicits voluntary feedback on the customer’s experience.