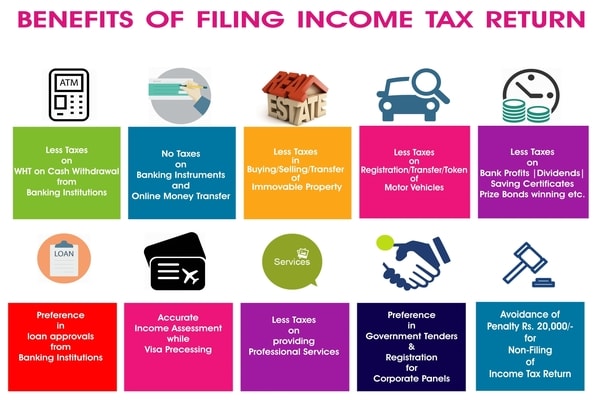

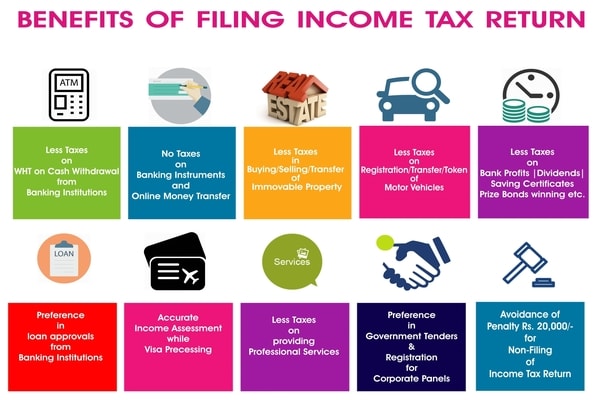

Income Tax Return benefits

Income Tax Deductions for AY 2019-20: Whenever a calamity strikes any part of the country, scores of people go out of their way to support the victims. Some donate money, some goods and food, some people also volunteer to provide medical care. While it is a good idea to donate money, not many people are aware that they can also get a tax break for the noble act. However, there are certain conditions that one needs to follow to claim this benefit hidden under a clause of the mammoth Income Tax Act document.

Income Tax deduction on donation is available under Section 80G of the Income Tax Act.

Here are some of the most important points you should note for claiming tax break under Section 80G.

1. You can get tax deductions only by donating to institutions and funds approved by the government (See a list at https://www.incometaxindia.gov.in/Pages/acts/income-tax-act.aspx under Section 80G).

2. Always ask to see the registration certificate of the organisation you are donating to.

3. Donations to foreign entities and political parties do not qualify for deductions under Section 80G. Donation to political parties are covered under Section 80GGC.

4. Tax deduction under 80G can be claimed only for donating money, not anything in kind.

5. Since 2017-18, cash donations above Rs 2000 do not qualify for deduction under 80G.

6. You can donate as much as you want. However, there are limits on tax deductions you can claim, depending on the kind of fund or institution you are donating to. You can get a 100% tax deduction in most of the government run entities, but may only 50% in case of many private entities. The amount may further have a limit of the 10% of the adjusted gross total income.

7. The adjusted total income is the taxable income after all deductions other than 80G are taken into consideration.

8. You can claim deduction under 80G while filing Income-tax Return.

9. Always take a stamped receipt which should have registration number of the entity to which you have donated, its validity and also the PAN, section 80G benefit on the donated amount, name, address and the amount.