New PAN Card Rules

To prevent tax evasion and allow more flexibility to taxpayers, the Income Tax department has introduced new PAN card rules with effect from today. Last month, the Central Board of Direct Taxes (CBDT) had issued a notification announcing that the Income Tax Rules, 1962, has been amended with effect from December 5.

PAN card Application Form

From today if you apply for a new PAN card, you will be given a new application form wherein it will not be mandatory to mention the father’s name. So far it was mandatory to furnish father’s name as the same was also printed in PAN card. Now the I-T department has made an exception for those whose mother is a single parent. This amendment is meant to address the concerns of those PAN card applicants whose fathers are estranged or dead.

PAN applicants will continue to have a choice as to whose name they want to be printed on the card. In case no option is provided, then only the father’s name will be used. Even if you have given father’s name, then also you will have the option to mention mother’s name in your PAN card.

PAN card Mandatory for these Entities

- To prevent tax evasion by small businesses, the Income Tax department has made the holding of PAN card mandatory for all entities doing transactions worth at least 2.5 lakh in a financial year.

- The amendment also mandates that a resident person other than an individual, (e.g., Hindu Undivided family, firm, charitable trusts, association of persons, body of individuals, a local authority, company), who enters into a financial transaction of an amount aggregating to Rs 250,000 or more in a financial year, shall apply for a PAN on or before 31 May of the immediately following financial year.

For example, if the financial transaction is entered into during the FY 2018-19 and the taxpayer does not have a PAN, an application for allotment of PAN should be made before May 31, 2019. Consequently, the managing director, directors, partners, trustees, author, founder, Karta, chief executive officer, principal officer or office bearer of the person, or any person competent to act on behalf of the person referred to above, shall also be required to apply for PAN before such date.

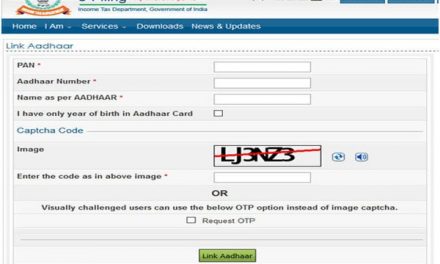

- Currently, tax authorities have been authorized to specify formats and standards for verification of documents filed with the PAN application/intimation of Aadhaar number, for ensuring secure capture and transmission of the data. Further, tax authorities are also responsible for evolving and implementing appropriate security, archival and retrieval policies in relation to furnishing of the application forms for allotment of permanent account number/intimation of Aadhaar number. As per the latest amendment, these have now been extended to the issue of Permanent Account Number as well.

PAN card in 4 hours

You might be able to get your PAN card in 4 hours soon as Income Tax Department is planning reform measures like PAN card in 4 hours, pre-filled income tax return forms for faster ITR processing. People can expect allotment of PAN card in just fours hours, to begin within 12 months.

The national daily report cited Central Board of Direct Taxes chairman, Sushil Chandra saying at a conference that the I-T Department is moving towards automation in areas like ITR filing, refund case selection, tax pre-payment etc. He further said that in order to facilitate ease of doing business in the country, ITR forms have been simplified and refund processing has also been frontloaded.

It may be noted that from today onwards (December 5), new PAN card rules will come into effect. The Income Tax department has now made it optional for individual taxpayers to furnish their father’s name in PAN card application form of applicants with single parents, which was mandatory before. in case the applicant’s father has passed away or separated, they can choose whether or not they want to mention their father’s name in their application form.

In order to prevent tax evasion by small businesses, the tax department has now also made PAN card mandatory for any entity doing transactions worth Rs 2.5 lakh or more in a financial year.

As per the new rule, “In the case of a person, being a resident, other than an individual, which enters into a financial transaction of an amount aggregating to two lakh fifty thousand rupees or more in a financial year and which has not been allotted any permanent account number, on or before the 31st day of May immediately following such financial year.

This rule will be applicable to managing director, director, partner, author, founder, CEO, trustee, Karta or office bearer of such entities.