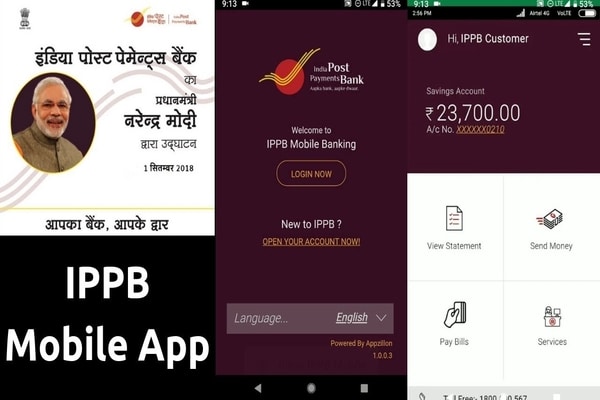

Prime Minister Narendra Modi launched the India Post Payments Bank on 1 September, the union government’s latest step towards financial inclusion of the remotest areas of India with its already existing vast network of post offices. You will now be able to avail banking services like a savings account or current accounts, money transfer (Through RTGS, IMPS and NEFT), direct benefit transfers and pay your utility bills using just your smartphone through IPPB’s Digital Savings Account.

The three types of savings accounts IPPB offers are – regular savings account, digital savings account and basic savings account. Interest rates on all three types of savings accounts are fixed at 4 per cent per annum.

Features of IPPB Digital Savings Account

- Banking at your convenience

- It can be opened instantly using IPPB’s mobile app

- Calculates interest rate of 4 per cent p.a. on end-of-the-day daily balance and it is paid quarterly

- No requirement of monthly average balance to be maintained

- The account can be opened with zero balance

- Free quarterly account statement

- Simple and instant fund transfer through IMPS

- Can make bill payments and recharges using the app

- A maximum yearly cumulative deposit of Rs. 2 lakhs is allowed in the account

- The Digital Savings account can be linked to a POSA (Post Office Savings Account) after completion of KYC within 12 months

Requirements

- Individuals must be above 18 years of age

- Aadhaar

- PAN (Permanent Account Number)

- KYC formalities have to be completed within 12 months of opening account; The account is subject to closure on failure to comply

- KYC formalities can be done by visiting any of the access points or with the help of the GDS/Postman, after which the Digital Savings Account will be upgraded to a Regular Savings Account.

How to open the account using the mobile app?

- The app is currently only available on Android. Keep your PAN and Aadhaar numbers handy.

- On your Android smartphone go to PlayStore and look for “IPPB Mobile Banking” (See picture for reference).

- Sign up for the Digital Savings Account by tapping the “Open your account now!” link. You will be lead to a “basic information” tab where you have to enter your basic details along with PAN and the phone number you wish to link the account to.

- The next page requires you to enter your Aadhaar number and asking you to check on the box if you have an Aadhaar based OTP account with another bank.

- Once you sign up, enter your other credentials including a phone number on the main page. An OTP will be sent to the phone number provided for authentication.

- Create an MPIN to complete setting up the account.