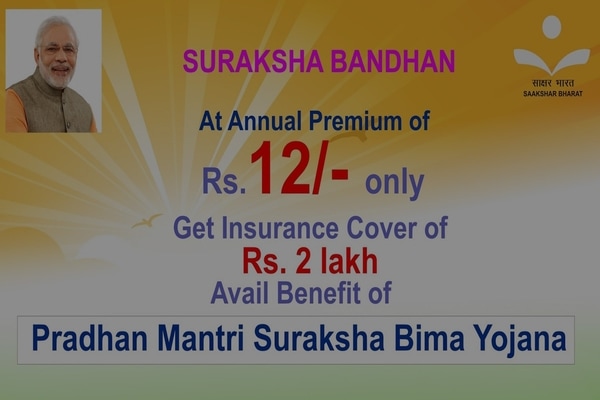

Pradhan Mantri Suraksha Bima Yojana

Pradhan Mantri Suraksha Bima Yojana (PMSBY) is one of three social security schemes that the government had announced. The other two being Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and the Atal Pension Yojana (APY).

What is PMSBY?

Here are the highlights of the scheme:

- Eligibility: All individual (single or joint) bank account holders in the 18-70 year age group are eligible to join PMSBY. In case you have multiple bank accounts in one or different banks, then you will be eligible to join the scheme through one bank account only. In the case of a joint account, all holders of the account can join the scheme. Even NRIs are eligible, but if a claim arises, the claimed benefit will be paid to the beneficiary/nominee only in Indian currency.

- Premium amount: Rs 12 per annum

- Coverage:

- Death: Rs 2 lakh.

- Total and irrecoverable loss of both eyes or loss of use of both hands or feet or loss of sight of one eye and loss of use of hand or foot: Rs 2 lakh.

- Total and irrecoverable loss of sight of one eye or loss of use of one hand or foot: Rs 1 lakh.

- Premium payment mode: The scheme covers the person insured between 1 June and 31 May of the following year. The premium needs to be paid within 31 May for an annual accidental cover from 1 June, through auto-debit mode only. It means that Rs 12 will automatically be debited from your bank account before 31 May in a single instalment towards the Pradhan Mantri Suraksha Bima Yojana. In case of joint account, all the account holders are covered and the premium will be paid at the rate of Rs.12 per person, per annum through auto-debit mode.

- Period of cover: You can take the cover separately every year or you can opt for a long-term cover, wherein the premium will be auto-debited from your account every year

Important inclusions and exclusions

How to Apply For PMSBY

Process-detail to activate through SMS

2. To enrol for the scheme, customer replies as ‘PMSBY Y’.

3. Customer will get an acknowledgement message for receipt of the response.

4. For processing the application, the demographic details and the nominee name, nominee relationship and nominee date of birth will be taken from the details present in the savings account.

5. In case, the nominee details are not available in core banking records, the confirmation will not be taken ahead for processing. Customer may then apply from the nearest branch/net banking.

6. In case, the auto debit of the premium fails due to insufficient funds or other reasons, the insurance cover ceases to be in-force.

Process-detail to activate through net banking:

2. You will be shown PMSBY at the relevant space.

3. Select the account through which you wish to pay your premium.

4. Policy cover amount, premium amount and nominee details (as per the selected account) will be displayed. You can choose to replicate the savings account nominee or add a new nominee.

*Good health declaration.

*Terms & Conditions/Scheme Details/FAQs.

*”I do not hold any other policy of the same”.

6. Click on ‘Continue’. You will then be shown the complete details of the PMSBY scheme you have registered for.

7. If you are okay with the scheme registration details displayed, click on ‘Confirm’.

8. Download the acknowledgement, which carries a unique reference number.

9. Do save the acknowledgement document for future reference. Till what period is the cover for

The accident cover of the member will terminate/be restricted in any of the following events:

i. On attaining age 70.

ii. Closure of bank account or insufficiency of balance to keep the insurance in force.

In case of death of the account holder, the claim can be filed by the nominee/appointee as per the enrolment form or by his legal heir/s in case there is no nomination made by him. The disability claim will be credited in the bank account of the insured bank account holder. Death claims will be remitted to the bank account of the nominee/legal heir(s).

You can download the claims form from http://www.jansuraksha.gov.in/Forms-PMSBY.aspx.