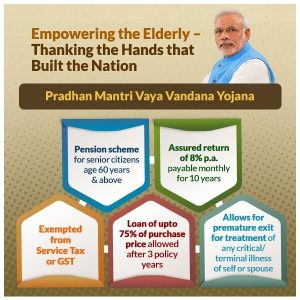

The Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a pension scheme implemented by the Govt of India for senior people aged 60 and over that was accessible from May 4, 2017, to March 31, 2020. The plan has now been extended to March 31, 2023, for a duration of three years after March 31, 2020. The scheme aims to safeguard elderly people aged 60 and up from a future drop in the interest rate due to unpredictable market situations, as well as to offer additional social security during old age. It was decided to create a streamlined scheme of guaranteed pension of 8% pa, which is being incorporated via the Life Insurance Corporation (LIC) of India.

Qualifying criteria for PMVVY

To be qualified for the Pradhan Mantri Vaya Vandana Yojana, an applicant must meet the following criteria:

- To be eligible for the program, he or she must be at least 60 years old.

- The coverage should be valid for ten years.

- The maximum investment limit for senior citizens is Rs. 15 lakh.

- The lowest pension can be Rs. 1,000/- per month, and the maximum pension can be Rs. 10,000/- monthly.

Method to apply for PMVVY

Pradhan Mantri Vaya Vandana Yojana applications are accepted both online and offline. To register for this scheme, please follow the steps outlined below:

Offline Procedure:

- Pick up an application form from any LIC office.

- You must then fill out the form with the necessary information.

- Following that, you must attach any necessary self-attested documents.

- After completing all of these processes, the form must be sent to any LIC branch, together with all supporting documentation.

Online Procedure:

- Go to the authorized LIC website & click on “Products.”

- Look up “Pension Plans.”

- Complete the application form seen under “Buy Policies.”

- Soft copies of the application and self-attested documentation should be submitted for further processing.

Perks of Pradhan Mantri Vaya Vandana Yojana

The following are some of the scheme’s major benefits:

- The scheme offers a guaranteed return of 8% per year, receivable monthly, and is excluded from service tax/GST.

- After three policy years, the plan gives a loan of up to 75% of the purchase cost.

- The plan also provides for an early exit for the emergency treatment of a major illness for oneself or one’s spouse. In the event of an early exit, 98% of the Purchase Price will be returned.

- The plan’s benefits are generally available to the pensioner, his or her spouse, and children.

- If the pensioner expires during the 10-year policy period, the nominee or heir can gain from the scheme.

How to Check PMVVY Policy Specifications

The following are the ways to examine the policy details:

- Navigate to the Umang PMVVY page.

- Browse to the ‘Policy Basic details’ section and choose the ‘Open’ option.

- In the next step, choose either ‘Login with MPIN’ or ‘Login with OTP’.

- Enter your phone number, and MPIN/OTP, and then select the ‘Login’ option.

- There under the ‘General Services’ header, choose the ‘Policy Basic Details’ option

- Fill in the ‘Policy Number’ & ‘Mobile Number’ fields, then hit the ‘View Details’ option.

- The specifics of the policy will be presented on the display.

Read More: Sneak Peak into the political career of Indian-Origin Uk’s Prime minister “Rishi Sunak”