Even today when talking about investment, most people recommend Fixed Deposit. FD is considered to be a better option for investing, in which returns are guaranteed with a guarantee. In this, you get higher returns than Saving Account. At the same time, many banks offer Senior Citizens Special FD Scheme to senior citizens.

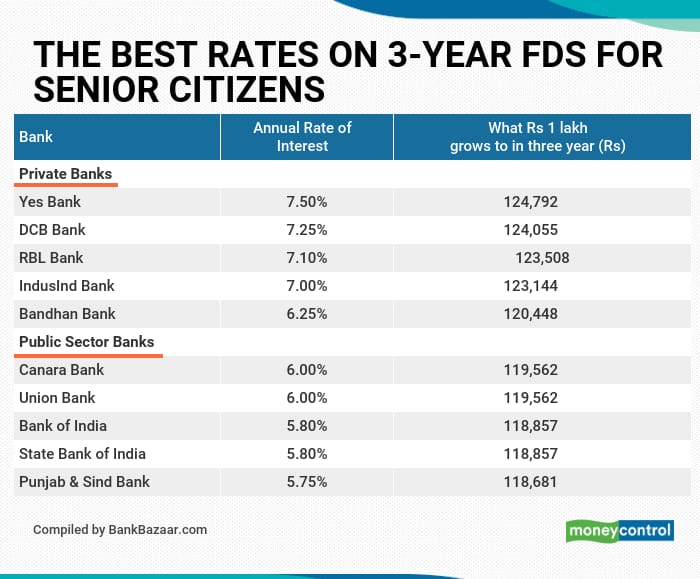

There are some banks like Yes Bank and DCB Bank which give good returns to senior citizens on FDs that are maturing in 3 years. The interest rate of the 3-year FD of these two banks is attractive. Explain that small banks pay more interest on FDs to customers than big banks.

Senior citizens prefer to invest in fixed deposits, as equity markets are highly volatile also there is a high risk of losing the principal amount. They prefer to earn a regular monthly income after retirement by investing the savings in the fixed deposits also it’s considered a safer investment avenue.

The falling bank deposit rates have reduced the monthly income of senior citizens sharply in the last year or so. This is because the banks have reduced the interest rates on fixed deposits across the tenures after a steady repo rate cut from the Reserve Bank of India (RBI) in 2020.

Despite falling interest rates, there are still some banks that are offering attractive rates on three-year FDs for senior citizens to lock-in. Some of the banks having special fixed deposit schemes for senior citizens are ending on March 31. Not surprisingly, the smaller private banks tend to top the rate chart on fixed deposits, given the competition they face in garnering deposits.