Most senior citizens prefer investing in bank fixed deposits (FDs) to earn a regular monthly income after retirement. However, falling bank deposit rates have reduced their monthly income sharply in the last year or so. This is because the Reserve Bank of India (RBI) has steadily cut repo rates. Banks have followed the same trajectory and gradually reduced the interest rates on fixed deposits across the tenures. The interest rate on small-saving schemes too has been cut in recent quarters.

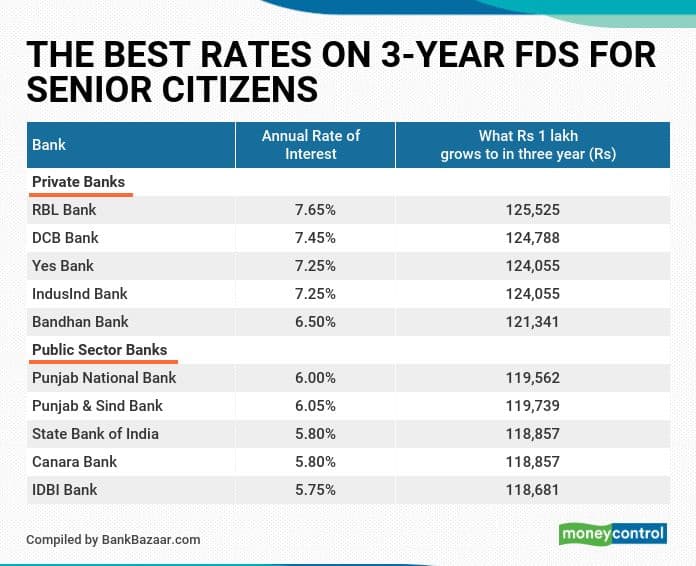

Despite falling interest rates, there are still some banks that offer attractive rates on three-year FDs for senior citizens. Not surprisingly, the smaller private banks tend to top the rate chart on fixed deposits, given the competition they face in garnering deposits.

Smaller private banks offer interest rates of up to 7.65 percent on three-year FDs for senior citizens, according to data compiled by BankBazaar. These interest rates on three-year FDs are higher compared to those offered by public sector banks. For instance, RBL Bank, DCB Bank, Yes Bank, and others, as shown in the table, offer 6.5-7.65 percent interest on their three-year FDs. Public sector banks such as Punjab National Bank, Punjab & Sind Bank, and State Bank of India offer 6 percent, 6.05 percent, and 5.80 percent, respectively, on their three-year FDs.

Leading private banks such as Axis Bank offer a 5.90 percent interest on three-year FDs. HDFC Bank and ICICI Bank offers 5.65 percent interest on three-year FDs for senior citizens. The established public sector banks such as Bank of Baroda and Union Bank offer 5.60 percent and 5.75 percent interest, respectively for the same tenure.

Investments in fixed deposits of up to Rs 5 lakh are guaranteed by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of the RBI.

The minimum investment amount varies across banks. At private and public banks, the amount ranges from Rs 100 to Rs 10,000.

The data on FDs is on September 23, 2020, as given in the respective websites. Interest rates given are for senior citizens of 60-80 years age (deposit amount below Rs 1 crore). All listed (BSE) public sector banks and private banks are considered for data compilation. Banks for which verifiable data is not available are not considered. For all FDs, quarterly compounding is assumed.