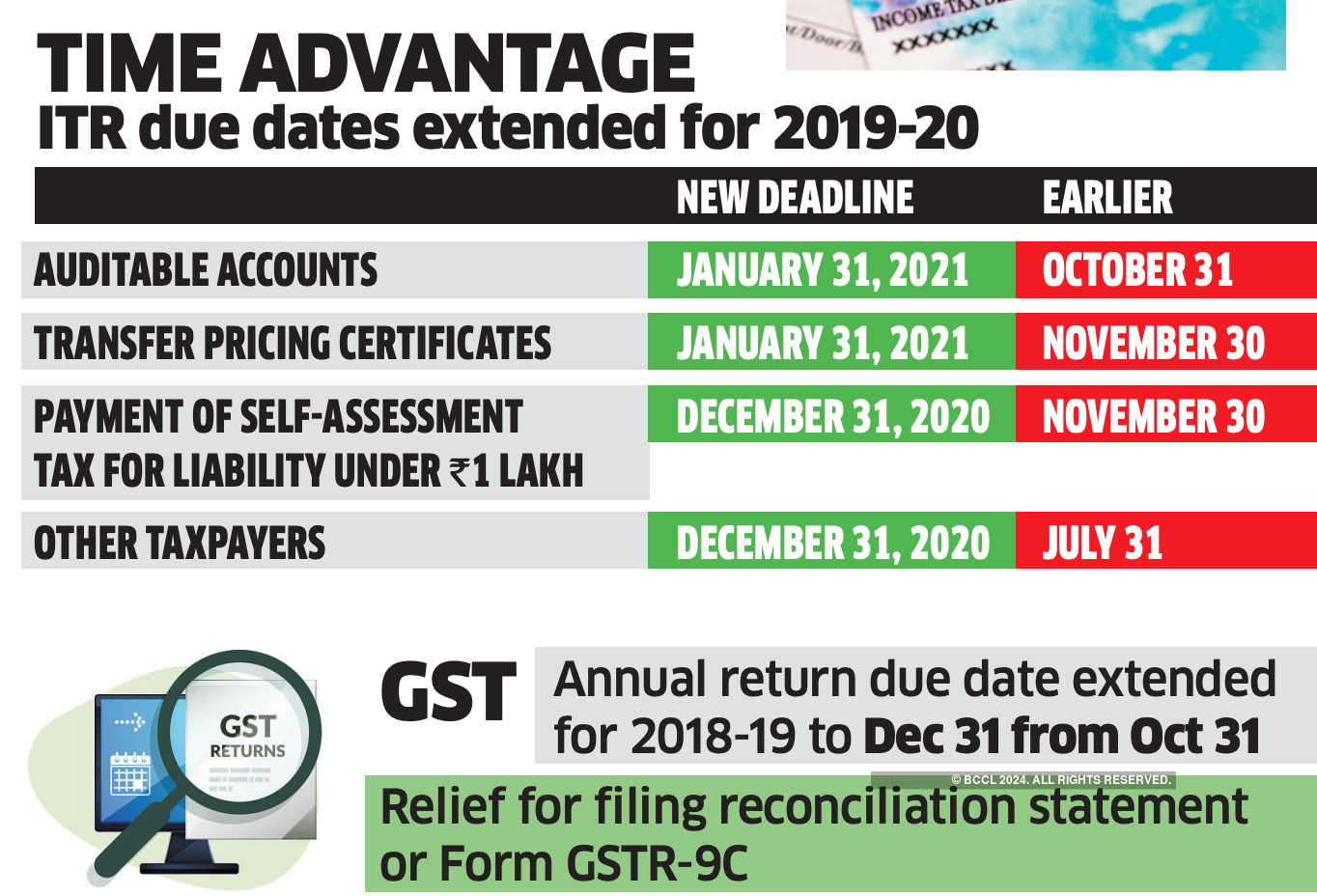

The income tax return (ITR) filing deadline for FY 2019-20 has been further extended to December 31, 2020, for most individual taxpayers, from the earlier deadline of November 30, 2020. This the second time the tax filing deadline for FY20 has been extended.

Also read: CPCB Recruitment 2020: Application begins for consultant posts, check details here

As per the government’s press release issued on October 24, 2020, “In order to provide more time to taxpayers for furnishing of their ITR, it has been decided to further extend the due date for furnishing of Income-Tax Returns as under:

The due date for furnishing of income tax returns (ITR) for these individual taxpayers [for whom the due date (i.e. before the extension by the said notification dated June 24, 2020, as per the Act was 31st July 2020] has been extended to 31st December 2020.

The due date for furnishing of Income Tax Returns for the taxpayers (including their partners) who are required to get their accounts audited [for whom the due date (i.e. before the extension by the said notification dated June 24, 2020) as per the Act is 31st October 2020] has been extended to 31st January 2021.

The due date for furnishing of Income Tax Returns for the taxpayers who are required to furnish a report in respect of international/specified domestic transactions [for whom the due date (i.e. before the extension by the said notification dated June 24, 2020) as per the Act is 30th November 2020] has been extended to 31st January 2021.

Consequently, the date for furnishing of various audit reports under the Act including tax audit report and report in respect of international/specified domestic transaction has also been extended to 31st December 2020, said the government in a press release.

.

.Mean-while, With 45,576 new COVID-19 infections, India’s total cases are now close to 90 lakh. With 585 new deaths reported in the last 24 hours, the toll mounts to 1,31,578. Of the 89,58,484 infections, active cases dropped to 4,43,303, while as many as 83 lakh people have been discharged.

.

.Delhi’s coronavirus tally on Wednesday climbed to over 500,000 after 7,486 fresh cases and 131 new fatalities were recorded in the last 24 hours, pushing the death toll to 7,943. This is the highest number of deaths reported in the city so far. Amid a spike in Covid-19 cases in the city, Health Minister Satyendar Jain on Wednesday reiterated that there will be no lockdown in the national capital, but said that there can be local restrictions at some busy places.

The Covid lockdown has set off sweeping economic distress in cities but its crucial dimension has remained untold: the silent, devastating toll on the working woman in the city suddenly out of work. Now locked out of the job market, they are being pushed to debt; some are selling off household items their incomes had helped buy, others are returning to places where they came from – all in a desperate search for a job. The Indian Express spoke to a few of them about their hardships