It’s raining offers on loans and credit cards this festive season, as banks and consumer goods companies look to woo customers with low-interest rates, cash backs and discounts. It is difficult to resist the temptation to buy the products on offer even if you cannot afford them, by using no-cost EMIs and other schemes on offer. These apart, many individuals who are facing a cash crunch induced by COVID-19-induced economic upheaval, too, could be tempted to take personal loans to meet their immediate needs. However, it is best to avoid personal loans for making big-ticket purchases or for your liquidity needs.

Unsecured debt such as personal loans should be your last resort in such cases. If you have indeed exhausted all your options and have no choice but to take a personal loan, ensure that you carry out a thorough analysis of interest rates and other loan terms and conditions on offer.

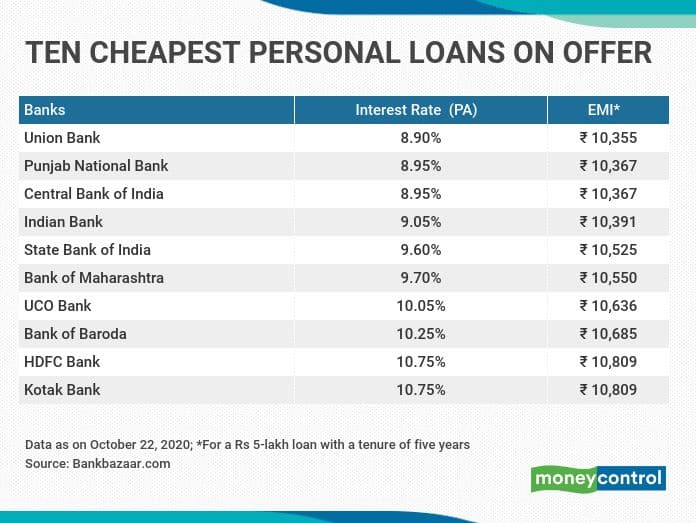

Public sector banks offer cheaper loans

Public sector banks have an edge over their private-sector competitors in terms of offering lower interest rates, according to data compiled by Bankbazaar. Eight out of the top ten banks offering the lowest interest rates on personal loans happen to be state-owned banks. These banks charge interest in the range of 8.90-10.25 percent a year on a Rs 5-lakh personal loan with a tenure of five years. Union Bank offers the cheapest personal loan at an interest rate of 8.9 percent, closely followed by Punjab National Bank with 8.95 percent. The equated monthly installments work out to Rs 10,355 and Rs 10,367, respectively. Banking colossus State Bank of India charges an interest of 9.6 percent. The two private sector banks in the list – HDFC Bank and Kotak Mahindra Bank – levy interest of 10.75 percent.

Note on the table

Interest rates on personal loans for all listed (BSE) public and private sector banks are considered for data compilation; Banks for which data is not available on their website, are not considered. Data is collected from the respective bank’s website as on October 22, 2020 (processing and other charges are assumed to be zero for EMI calculation); Interest and charges mentioned in the table are indicative and may vary depending on banks’ terms and conditions.

Mean-while, India has reported a daily jump of 49,881 Covid-19 cases, even as the tally has soared past the 8-million mark. The country’s death toll has mounted to 120,699. Out of the total Covid-19 cases, 603,687 are currently active, 7,315,989 have been discharged, while 1,20,527 lost the battle against the pandemic.

.Amid the festive season and rising pollution level, Delhi on Wednesday recorded over 5,600 fresh cases for the first time, with the city witnessing a sudden surge in daily incidences in the past few days. According to the latest health department bulletin, the positivity rate has also jumped to 9.37 percent, as the infection tally in the city has mounted to over 370,000.