The Reserve Bank of India (RBI) has removed caps on the pricing of small loans given by non-banking financial company-microfinance institutions (NBFC-MFIs), bringing them to the same level as other such lenders, including banks. With this, the underwriting of loans will be done on a risk-based analysis, and a risk premium will be charged based on the borrower.

Previously, there were limits set on the maximum interest rate that a microfinance lender could charge on loans which was set at a maximum of 10-12 percentage points above the institutions’ cost of funds or 2.75 times the average base rate for top five commercial banks.

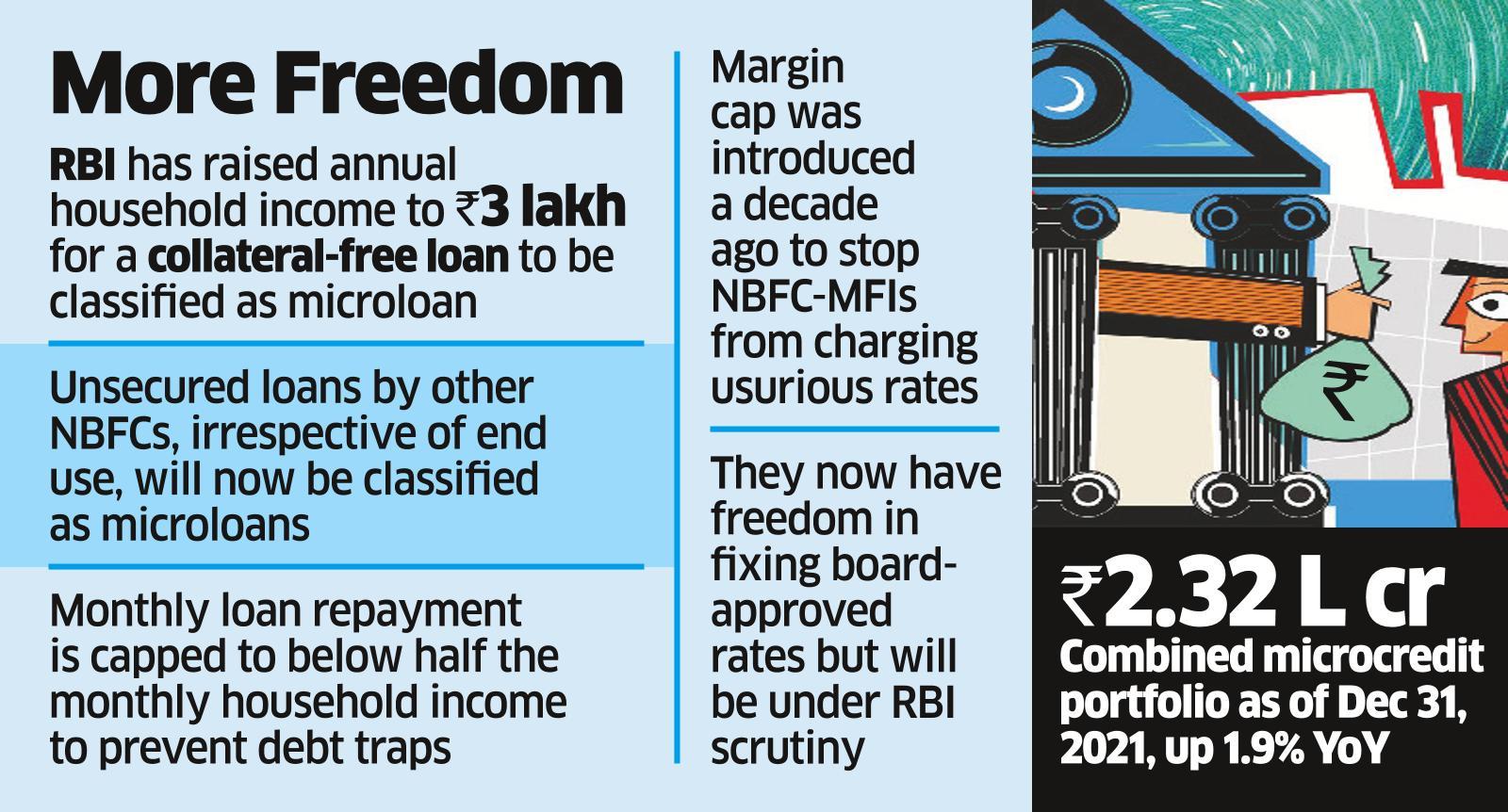

Any loan given without a collateral to a household having an annual income of up to 300,000 Indian rupees ($3,918) is considered to be a microfinance loan.

The RBI had put out a discussion paper on microfinance loans in June 2021 and released final guidelines after taking into account comments received from stakeholders.

The changes announced on Monday will come into effect on April 1.

To protect borrowers from falling into a debt-trap — an issue that keeps haunting the sector — the regulator capped the monthly loan repayment of borrowers, saying that it should not exceed half the monthly household income. Also, no loan can be linked to a lien on the deposit account of the borrower, the RBI said. There will be no prepayment penalty on microfinance loans.

“The rule of a 50% fixed obligation to income ratio being applied uniformly to all categories of borrowers will reduce the pressure, lower delinquency and lower credit costs for the industry,” said Manoj Nambiar, managing director of Arohan Financial Services..

The margin cap on lending rates was introduced a decade back to stop NBFC-MFIs from charging usurious rates. The RBI now offered freedom in fixing board-approved lending rates, but warned that those should not be usurious and that the rates would come under its supervisory scrutiny.

The removal of the interest rate cap would allow these lenders to go for risk-based pricing, said Sadaf Sayeed, chief executive of Muthoot Microfin. “Raising the household income threshold will help MFIs reach many more households. With a level playing field and increased competition, the end customers will benefit,” he said.

Banks remain the largest microfinance lenders with an about 40% market share, followed by NBFC-MFIs, small finance banks, other NBFCs and NGOs. Their combined microcredit portfolio stood at Rs 2.32 lakh crore at the end of December last year, registering 1.9% growth year-on-year, according to latest data released by industry association Sa-Dhan.

The RBI had issued a draft consultative document on regulation of microfinance loans in June last year. Now, it issued the final guidelines based on the feedback it received.

The harmonised regulations will address concerns related to the over-indebtedness of microfinance borrowers, said Alok Misra, chief executive of Microfinance Institutions Network, the industry lobby group.

The regulator has told NBFC-MFIs to raise their net-owned fund to Rs 7 crore by March 31, 2025 and to Rs 10 crore by March 31, 2027 from Rs 5 crore at present. It reduced the minimum requirement of microfinance loans in the total loan assets of NBFC-MFIs to 75% from 85%, to reduce the risk concentration.

The regulator has told NBFC-MFIs to raise their net-owned fund to Rs 7 crore by March 31, 2025 and to Rs 10 crore by March 31, 2027 from Rs 5 crore at present. It reduced the minimum requirement of microfinance loans in the total loan assets of NBFC-MFIs to 75% from 85%, to reduce the risk concentration.