SBI new rules 2020: For customers of the State Bank of India (SBI), the new year comes with three new changes in rules. Starting January 1, these changes in the services offered by the bank will become effective to improve customer experience. Upgrading to EMV chip debit cards, one-time password (OTP)- based ATM transactions and lower external benchmark-based rates are the services that will undergo changes.

Here are some of the SBI new rules 2020:

Home loans to get cheaper

The external benchmark-based lending rate (EBR) is reduced by 25 basis points (BPS), which will result in customers availing cheaper home loans. From the earlier 8.05 percent, the EBR will be revised to 7.80 percent. Consequently, for home loan borrowers and micro, small and medium enterprise (MSME) borrowers, the loans which are linked to the EBR will come at a cheaper rate of interest. The new home buyers will get loans at an interest rate starting from 7.90 percent per annum compared to earlier 8.15 percent per annum.

OTP-based ATM transactions for SBI customers

For all cash withdrawals above Rs, 10,000 made between 8 pm and 8 am starting January 1, SBI cardholders will have to enter an OTP. The rule, however, is only applicable to SBI ATMs and seeks to make transactions more secure. Customers will receive the OTP on their mobile numbers registered with the bank.

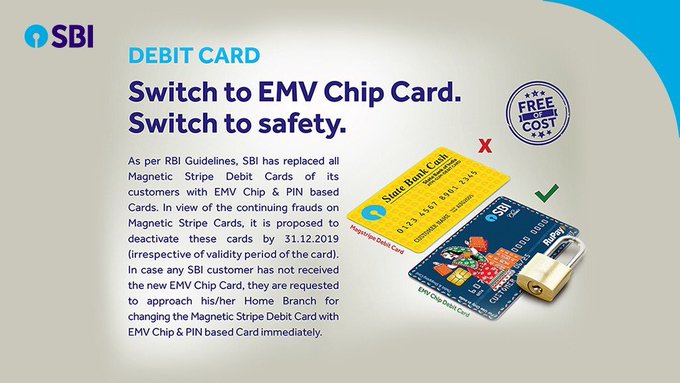

SBI has asked all its customers to switch to EMV chip-based ATM and debit cards ahead of the new year. All SBI ATM-cum-debit cards with magnetic stripes will become invalid from January 1 onward. SBI Chairman Rajnish Kumar earlier said in August that the bank was planning to achieve a ‘debit card-less country’.

Apply now to change your Magnetic Stripe Debit Cards to the more secure EMV Chip and PIN based SBI Debit card at your home branch by 31st December, 2019. Safeguard yourself with guaranteed authenticity, greater security for online payments and added security against fraud.