Online ITR Filing: If you also have to file an income tax return, then this is the news of your great benefit. Today we will tell you about some such websites to file Income Tax Return (ITR Filling), through which you can file taxes for free. You have to submit your Form-16 on these websites. Apart from this, you have to give necessary information related to your salary and income. Let us tell you that the last date for filing ITR for the financial year 2020-21 (The assessment Year 2021-2022) is 30 September 2021.

The Income Tax Department has created a portal for the e-filing of income tax returns, through which you can file tax returns. Apart from this, some private organizations provide free e-filing facilities through their website.

Here are the lists of some websites, through which you can file ITR for free-

MyITreturn

myITreturn is an authorised e-return intermediary registered with the Income-tax Department, Government of India. It was started in the year 2006 and is a subsidiary of Skorydov Systems Private Limited. It provides users an option to file ITR in over 9 Indian languages. (English, Hindi, Gujarati, Marathi, Tamil, Telugu, Kannada, Malayalam, Bengali and Punjabi)

They too provide a hyperlink in Form 16 wherein one has to just click and the data converts into ITR through secured encryption. So there is no need to download, save or upload Form 16 at ITD or any other website.

The cost of various packages can be seen by clicking here.

On the safety aspect, this is what they say: “Our website is https and the security is like the bank grade security and being controlled as well as trusted by income tax department as one of the first ERI (without any complaint or notice from them. We keep the data on servers managed by a leader like Amazon.”

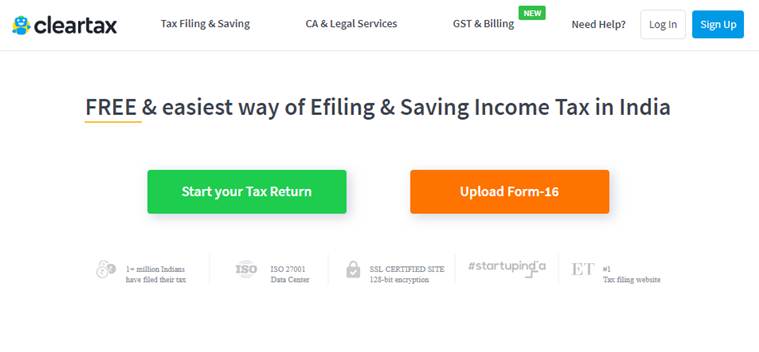

ClearTax

For filing ITR online using ClearTax platform, one will have to upload Form 16, claim his deductions and he will get his acknowledgment number online. People can e-file income tax return on their income from salary, house property, capital gains, business and profession and income from other sources. On this website, taxpayers can also file TDS returns, generate Form-16, use its Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.