The India Post’s National Savings Monthly Income (MIS) scheme is one of the most widely known risk-free savings plans in the country. In general, India Post’s investment options are among the most trusted in the market. While they provide a low return when compared to other options, their risk-free nature and government backing make them popular among investors, particularly older ones. The Post Office MIS policy is designed for those who want to invest their money in a government-run scheme that guarantees fixed returns.

The Post Office Monthly Income Scheme also guarantees fixed returns to investors at the rate of which the money was invested initially. Apart from this, it acts as a tax saving scheme for middle and low income group investors, who can claim tax exemption under the Income Tax Act by investing in this scheme.

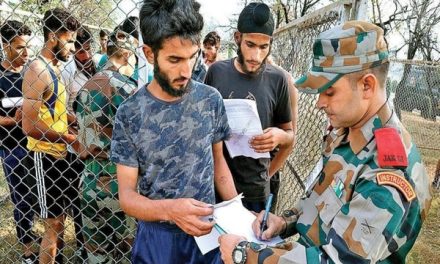

By submitting the necessary documents, an account under this scheme can be opened at the nearest post office. Interested investors who want to open an MIS account should keep in mind that the minimum amount required to open the account is Rs. 1,000. Following that, deposits must be made in multiples of Rs 1,000, according to Post Office guidelines. This rule went into effect on April 1, 2020.

The government revises the interest rate based on the market situation and for the quarter ending on September 30, 2021, the interest rate was set at 6.6 per annum. Investors have the option to withdraw the interest directly from the post office or get it transferred to their savings account. The Post Office has also added the option to move the funds to a recurring deposit account.