Online fund transfer gets a boost as far as the cost to transfer money from one account to another is concerned. Reserve Bank of India on Tuesday said it will waive all charges on fund transfer through RTGS and NEFT. That is because banks, in turn, used to pass on these fees to their customers using these services.

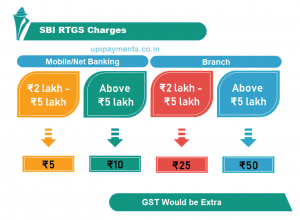

Country’s largest bank State Bank of India (SBI) charges between Rs 1 and Rs 5 for transactions through NEFT and between Rs 5 and Rs 50 for RTGS route. The Reserve Bank levies “minimum charges” on banks for transactions routed through its RTGS and NEFT, and banks, in turn, levy charges on their customers.

Country’s largest bank State Bank of India (SBI) charges between Rs 1 and Rs 5 for transactions through NEFT and between Rs 5 and Rs 50 for RTGS route. The Reserve Bank levies “minimum charges” on banks for transactions routed through its RTGS and NEFT, and banks, in turn, levy charges on their customers.

The Real Time Gross Settlement System (RTGS) is meant for large-value instantaneous fund transfers while the National Electronic Funds Transfer (NEFT) System is used for fund transfers of up to Rs 2 lakh. The waiver is effective from July 1, however, it remains to be seen, if the banks actually pass on the benefit to the account holders during online fund transfers.

NEFT Charges:

As per the RBI website, the structure of charges that was to be levied on the customer for NEFT is given below:

(a) Inward transactions at bank branches for credit to beneficiary accounts are free and no charges can be on beneficiaries.

(b) Outward transactions at originating bank branches :

- For transactions up to Rs 10,000: not exceeding Rs 2.50 (+ Applicable GST)

- For transactions above Rs 10,000 up to Rs 1 lakh: not exceeding Rs 5 (+ Applicable GST)

- For transactions above Rs 1 lakh and up to Rs 2 lakh: not exceeding Rs 15 (+ Applicable GST)

- For transactions above Rs 2 lakh: not exceeding Rs 25 (+ Applicable GST)

RTGS charges:

Under RTGS, the fund transfer happens on a real-time basis depending on an individual order. The RTGS system is primarily meant for large value transactions and the minimum amount to be remitted through RTGS is Rs 2 lakh. There is no upper ceiling for RTGS transactions. Depending on the amount and the time of transfer, the RTGS charges vary across banks. The SBI RTGS Charges varies between Rs 25 and Rs 56 inclusive of taxes. These charges, however, may become free as and when banks start waving them for the users.