Tax Free Bonds: There are very few instruments in India, where the interest earned is tax free in the hands of investors. One of them is the Public Provident Fund, while the other is the interest earned on the Employees Provident Fund. However, in the case of the EPF one has not to withdraw the amount for 5-year to avail tax free income. Another instrument that offers tax free interest income in India is the tax free bonds.

What are Tax-Free Bonds

Tax-free bonds are issued by a government enterprise to raise funds for a particular purpose. One example of these bonds is the municipal bonds issued by municipal corporations. They offer a fixed interest rate and rarely default, hence are a low-risk investment avenue.

As the name suggests, its most attractive feature is its absolute tax exemption on interest as per Section 10 of the Income Tax Act of India, 1961. Tax-free bonds generally have a long-term maturity of ten years or more. The government invests the money collected from these bonds in infrastructure and housing projects.

Where to buy tax free bonds and what is the interest rates?

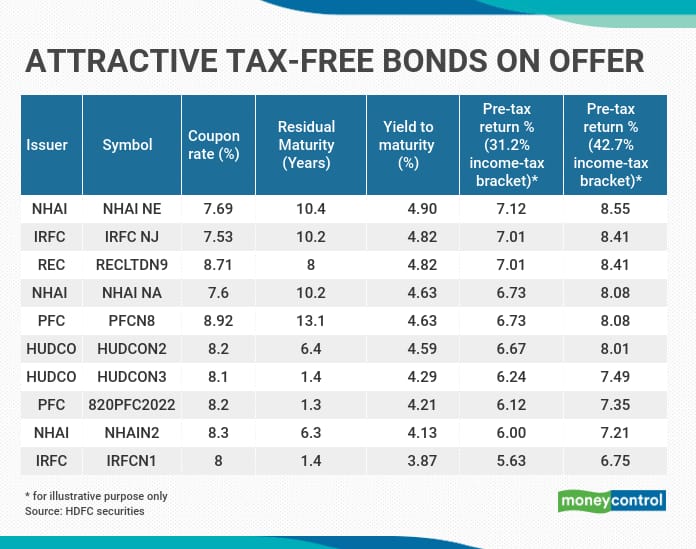

If you have a trading and demat account to buy shares, you can buy tax free bonds. For example, just as you would buy shares and hold in your demat account, so also you can buy bonds and hold in your demat account. These tax free bonds are listed on the BSE and NSE just like shares.

Now let us take an example and provide some more details. The NA series of Bonds of Indian Railways Finance Corporation offers an interest of 8.65% every year, which is tax free. The interest is payable in Feb every year and the bonds mature in 2029. While the interest is 8.65%, the bonds are priced at Rs 1,250, which means your yields drop.

Who should invest in Tax-Free Bonds

Tax-free bonds are an excellent choice for investors looking for fixed income like senior citizens. As government enterprises typically issue these bonds for a longer tenure, default risk is very low in these bonds and you are assured of a fixed income for a more extended period, typically ten years or more.

The government enterprises invest the money collected through the issuance of these bonds in infrastructure and housing projects. Tax-free bonds are the right choice for investors falling in the highest tax bracket.

Typically high net-worth (HNI) individuals, HUF members, trusts, co-operative banks, and qualified institutional investors prefer to invest in tax-free bonds.

How to invest in Tax-Free Bonds

Tax-free bonds have trading options that allow bond trading through a Demat account or in physical form. Therefore, investing in these bonds is simple and highly rewarding. Remember, the subscription period for the investment is open only for a specific time.

You must submit your PAN details when opting for the physical format and do your KYC. When the government issues bonds to the public, the investor can subscribe by applying online or offline.

On the other hand, if an investor requests for the bond post-issuance, investment is through the trading account. Hence, it is similar to trading shares in a stock market.